Posts Tagged ‘Dana McGuffin CPA PLLC’

Recording Simple Expenses in QuickBooks Online

How does most of the money you owe individuals and companies get disbursed? The simple expenses. Do you print checks, or write them by hand? Use credit cards? Pay online through your bank’s website? Keeping track of your outgoing funds can be challenging, since there are so many ways to complete those transactions. But…

Read MoreKeep Your Audit Fears in Check

Audit fears are real! Your chances of being audited are probably lower than you think. A look at the latest IRS statistics for 2016 reveals some interesting and reassuring facts about the risk of an IRS audit. Audits are becoming less common. The number of individual tax returns the IRS audited fell to a…

Read More4 Tips To Landing Your Dream Home In A Seller’s Market

It’s a tough time to buy a house. With high prices and low supply, homebuyers have to tackle the buying process differently than they would in a flat or down market. Here are some suggestions to landing your dream home in our current real estate market. Be nimble, be flexible. Try to investigate new listings…

Read MoreSummer Vacation Without Breaking The Bank

When setting your family budget, often the first thing that gets slashed is the summer vacation. However, if you plan ahead, you can find simple ways to save and keep your vacation on the calendar. Here are a few ideas. Flexible location. Sometimes you just want to get away to recharge and the location isn’t…

Read MoreCommon Audit Red Flags – What Attracts the IRS

For handwritten taxpayers, preparing their tax return isn’t the problem. It’s the fear of an audit. Audits are fairly uncommon, but the IRS may notice your tax return if certain red flags are present. Here are some of the common audit red flags to help you prepare for the possibility of your return being reviewed.…

Read MoreFour Tips for Working Beyond Retirement Age

Four tips for working beyond retirement age Many people choose to work into their retirement years. If this is something you’re considering, here are some tips to make sure you get the greatest benefit from your efforts. 1) Consider delaying Social Security. You can start receiving Social Security retirement benefits as early as age 62,…

Read MoreBe Tax Wise When Withdrawing your Retirement Savings

You’ve spent years saving for retirement, but now it’s time to plan the best way to manage your retirement savings withdrawals. Here is a potential method to help maximize your funds using a tax-advantaged strategy. First, look at Social Security and pensions. You can use these funds for daily living much the same as you…

Read MoreAlimony In The IRS Spotlight

A couple of years ago, the U.S. Treasury released a report highlighting a disturbing level of non-compliance in alimony reporting on tax returns. Since the report was released, the IRS has increased the scrutiny they place on tax returns with these claims. If you file a tax return involving alimony, make sure you know the facts…

Read MoreWhen Business Travel Insurance Makes Sense

There are many things that come in pairs because they make sense – peanut butter and jelly, salt and pepper, shoes – the list goes on and on. Travel insurance for business travel is no different. There are inevitable changes to business travel or circumstances that arise while away from home. One way to…

Read MoreKnowing “the Line” Creates Opportunity

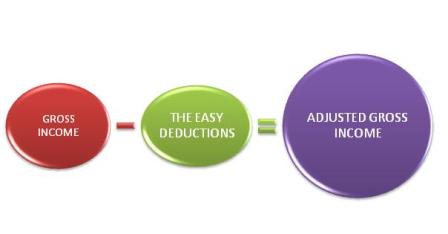

KNOWING “THE LINE” CREATES OPPORTUNITY A simple way to think about your 1040 tax return is focusing on a single line, your Adjusted Gross Income (AGI). Anything “above the line” creates an AGI that can yield tax opportunities or tax consequences for anything “below the line.” Being aware of “the line” and the impact it…

Read More