Posts Tagged ‘Dana McGuffin CPA PLLC’

Cures Act Authorizes New Breed of Small Employer Health Reimbursement Arrangements (HRAs)

The 21st Century Cures Act, a new law signed late in 2016 that helps fund medical research, also provides a cure for the health insurance woes of small employers. Under this legislation, your small business may now offer stand-alone Health Reimbursement Arrangements (HRAs) for employees. An HRA is a special account used to pay health…

Read MoreDepreciation Made Easy for 2017

If your eyes glaze over when you read the word “depreciation” you are not alone. While depreciation is simply deducting the cost of business equipment over time, special tax provisions allow flexibility in how much can be expensed in a given year. The first solution is the Section 179 deduction. You are able to…

Read MoreWhen Business Travel Makes Sense

There are many things that come in pairs because they make sense – peanut butter and jelly, salt and pepper, shoes – the list goes on and on. Travel insurance for business travel is no different. There are inevitable changes to business travel or circumstances that arise while away from home. One way to protect…

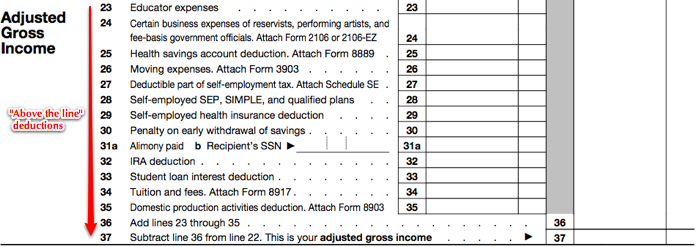

Read MoreKnowing “The Line” Creates Opportunity

A simple way to think about your 1040 tax return is focusing on a single line, your Adjusted Gross Income (AGI). Anything “above the line” creates an AGI that can yield tax opportunities or tax consequences for anything “below the line.” Being aware of “the line” and the impact it has on your tax return…

Read MoreCures Act Authorizes New Breed of Small Employer Health Reimbursement Arrangements (HRAs)

The 21st Century Cures Act, a new law signed late in 2016 that helps fund medical research, also provides a cure for the health insurance woes of small employers. Under this legislation, your small business may now offer stand-alone Health Reimbursement Arrangements (HRAs) for employees. An HRA is a special account used to pay health…

Read MoreUse Recurring Transactions in Quickbooks Online

Save time and ensure that recurring transactions are processed as scheduled. You know how much time QuickBooks Online already saves you. Customer, vendor, and item records need never be entered again once they’re created for the first time. Pre-built forms use your record data to complete transactions quickly and accurately. Customizable report templates provide real-time overviews…

Read MoreTax Planning By The Numbers: Updates for 2017

Are you ready to get started on your 2017 tax planning? Here are the numbers to use to take full advantage of retirement and other tax-advantaged savings. If you’re under full retirement age, the social security earnings limit is $16,920. That means if you collect benefits before your full retirement age and earn more than…

Read More5 QuickBooks Online Add-On Apps You May Need in 2017

Not finding quite everything you need in QuickBooks Online? Here are some handy add-on apps available. QuickBooks Online may work for you just fine as is. After all, it was designed to meet the needs of the millions of organizations that want to manage and track their income and expenses, create records and transactions, and…

Read MoreHave You Created An Emergency Records Binder?

With weather-related disasters making the news these days, emergency preparedness may be front of mind. You probably have tools to cope with a flat tire, or a hurricane lantern or candles for times when the electricity to your home is interrupted. But have you considered what records you might need if your wallet was stolen?…

Read MoreStart 2017 With A Review Of Your Insurance Coverage

Do you have the right insurance for your business? Here’s a list of policies to consider. Liability insurance covers damages and defense for bodily injury, personal injury such as slander, and property damage to a third-party that is caused by you, your products, or your employees. Property insurance covers your building and personal property such…

Read More