Archive for June 2015

Get a Tax Credit for Dependent Expenses

Did you know that federal tax law allows you to claim a credit when you pay someone to care for your kids while you’re at work? The child and dependent care credit is valuable because it reduces the amount of tax you owe dollar for dollar. Here’s an overview of the rules. The child care…

Read MoreSupreme Court Issues Ruling on ACA Subsidies

In June, the U.S. Supreme Court decided the fate of the premium tax credit under the Affordable Care Act (ACA). The main issue before the court was whether federal subsidies could be offered to people who purchased health insurance through the federal health insurance marketplace rather than through a state-run exchange. Under a literal reading…

Read MoreCreating QuickBooks Online Reports

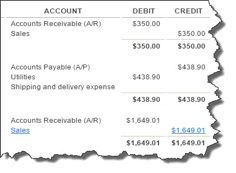

Reports are the payoff for all of your hard work entering records and transactions. They can give you the critical data you need to help you make better business decisions. Now that you’ve been using QuickBooks Online for your company’s accounting, it’s probably unimaginable to think about going back to manual bookkeeping. Those file folders…

Read More