Posts Tagged ‘Best Southlake CPA’

“Wash Sales” Rule And Your Tax Planning

As the end of another year approaches, you’re looking for ways to reduce your tax bill. You have a handful of stocks in loss positions. You like the stocks and expect the prices to rebound. Should you sell now at a loss to offset other capital gains, then buy the shares right back again? Not…

Read MoreData Security Is An Essential Part Of Customer Care

Security breaches of confidential data capture the global news headlines on a daily basis. Identity theft has become so commonplace that credit card companies and banks market their protection efforts as free services to their customers. The IRS is at risk too, with impersonators using the fear and authority of the government to prey on…

Read MoreThe Taxing Side Of Divorce

Are you getting a divorce? Amid all the upheaval, taxes are not likely to be foremost on your mind. Yet overlooking the tax consequences can be costly. Here are some of the basics. Your filing status will change. No matter if you get your final divorce decree or separate maintenance on January 1, December 31,…

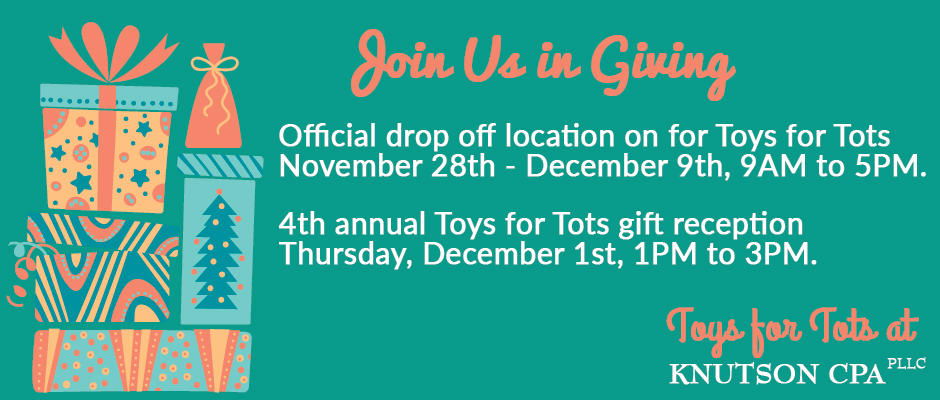

Read MoreToys for Tots at Dana McGuffin CPA 2016

We are SO excited to be an official drop-off location for Toys for Tots 2016 and will be gratefully accepting new, unwrapped toys November 28th – December 9th, from 9AM to 5PM. Please join us for cupcakes and coffee at our 4th annual Toys for Tots gift reception Thursday, December 1st from 1-3PM. Our office…

Read MoreTeach Your Kids To Use Credit Cards Responsibly

No doubt you have shared the adage “if it sounds too good to be true, it probably is” with your children. That caution is wise, especially when teaching your kids how to use credit cards responsibly, because misuse of credit can have a long-term impact on financial health. The main lesson you want to impart:…

Read MoreConsider The Financial Impact Of A Job Transition

Are you ready to begin a job search or launch a career transition? Here are suggestions to manage your finances wisely before making the change to new employment. Plan your income stream. Check for a gap in pay dates and make plans to have enough savings set aside to tide you over. Include increased commuting…

Read MorePayroll Responsibilities Go Beyond Writing Paychecks

As an employee, you may not have thought much about the procedures behind the issuance of your paycheck. But as a new business owner, you’ll need to understand how federal employment taxes work because you’ll have to withhold these payroll taxes from your employees’ paychecks. Here’s an overview of four types of payroll tax. Social…

Read MoreNavigate Business Changes Successfully

Change happens. That’s especially true in the business world, where changes may be mandated by tax or regulatory requirements, increased competition, shifts in customer needs, or technological advances. Whatever your reason for making a change in your business, managing the process effectively is the best way to succeed. Here are suggestions for handling change. Clarify…

Read MoreTips To Manage Work-From-Elsewhere Employees

It’s a mobile world, and your employees may be asking to work from a location other than your office. Adapting to this request can allow you to keep quality talent and accommodate workers who may have health or other issues that make working in a traditional office difficult. But managing employees from a distance can…

Read More“Crowdfunding” Raises Tax Issues

Raising funds in small amounts from a large pool of people, also known as crowdfunding, has become a popular way for budding entrepreneurs to drum up the working capital for pet projects. It seems like everyone from twenty-somethings to stay-at-home parents to retirees are getting in on the act. Here’s how the process works. Let’s…

Read More