Posts Tagged ‘Best Southlake CPA’

Alimony In The IRS Spotlight

A couple of years ago, the U.S. Treasury released a report highlighting a disturbing level of non-compliance in alimony reporting on tax returns. Since the report was released, the IRS has increased the scrutiny they place on tax returns with these claims. If you file a tax return involving alimony, make sure you know the facts…

Read MoreWhen Business Travel Insurance Makes Sense

There are many things that come in pairs because they make sense – peanut butter and jelly, salt and pepper, shoes – the list goes on and on. Travel insurance for business travel is no different. There are inevitable changes to business travel or circumstances that arise while away from home. One way to…

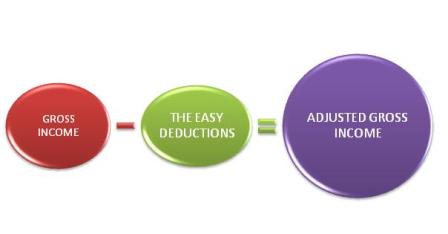

Read MoreKnowing “the Line” Creates Opportunity

KNOWING “THE LINE” CREATES OPPORTUNITY A simple way to think about your 1040 tax return is focusing on a single line, your Adjusted Gross Income (AGI). Anything “above the line” creates an AGI that can yield tax opportunities or tax consequences for anything “below the line.” Being aware of “the line” and the impact it…

Read MoreCures Act Authorizes New Breed of Small Employer Health Reimbursement Arrangements (HRAs)

The 21st Century Cures Act, a new law signed late in 2016 that helps fund medical research, also provides a cure for the health insurance woes of small employers. Under this legislation, your small business may now offer stand-alone Health Reimbursement Arrangements (HRAs) for employees. An HRA is a special account used to pay health…

Read MoreTax Planning By The Numbers: Updates for 2017

Are you ready to get started on your 2017 tax planning? Here are the numbers to use to take full advantage of retirement and other tax-advantaged savings. If you’re under full retirement age, the social security earnings limit is $16,920. That means if you collect benefits before your full retirement age and earn more than…

Read MoreStart 2017 With A Review Of Your Insurance Coverage

Do you have the right insurance for your business? Here’s a list of policies to consider. Liability insurance covers damages and defense for bodily injury, personal injury such as slander, and property damage to a third-party that is caused by you, your products, or your employees. Property insurance covers your building and personal property such…

Read MoreWill You Have to File a 2016 Tax Return?

The filing requirement rules for individual 2016 Tax Return are fairly straightforward. In general, you’re required to file a return based on your filing status, your gross income, and your age. Here’s an overview of the rules for 2016. 2016 Tax Return Single taxpayers (including those who are divorced or legally separated). If you’re under 65…

Read MoreDo You Need A Safe Deposit Box?

Though you may have thought bank safe deposit boxes no longer existed, these secure containers are still around, and can be useful for storing difficult to replace items, such as deeds, contracts, and your home inventory. Should you have one? Here’s what to consider. Peace of mind. Knowing that key original documents are in a…

Read MorePlanning To Retire? Consider Transferring Your Business To Your Employees

Dana McGuffin CPA is dedicated to helping increase organization sustainability in the businesses, ministries, and churches we serve. Even the most dedicated small business owners eventually want to retire. But succession planning can be tricky. If a transfer to an outside party isn’t feasible, and many times it is not, an alternative is to consider…

Read MoreWhat is a 1099 and Who Should Receive a 1099?

What is a Form 1099-MISC? And who should receive a 1099? IRS Form 1099-MISC summarizes income from all non-employee compensation. It’s what independent contractors use to calculate and file taxes. You must send out a Form 1099-MISC to all contractors you’ve hired and paid more than $600 during the year; this includes any partnerships or…

Read More