Dana McGuffin CPA Blog

On June 15, 2015 Texas Governor Greg Abbott signed into law a permanent reduction in the Texas Franchise Tax. There was a 25% reduction in both the retail rate which dropped from 0.5% to 0.375% and the non-retail rate which was reduced from 1.0% to 0.75%. In addition, the maximum revenue for filing the EZ…

Read MoreThe following is a midyear tax update of important developments that have occurred in the past three months that may affect you, your family, your investments, and your livelihood. Supreme Court upholds subsidies for health care purchased on Federal Exchange. The Supreme Court by a 6-3 vote determined that premium tax credits (also known as health…

Read MoreWendy Knutson, CPA, along with Sarah Gilliland, Lauren Midgley, Nicole Smith, Shannon Thomas released her new book Masterminding Our Way: The Power of 5 Minds. Create the magic for yourself and your business! Masterminding Our Way is now available on Amazon here. You are invited to the BOOK LAUNCH & SIGNING! When: Tuesday, August 4th…

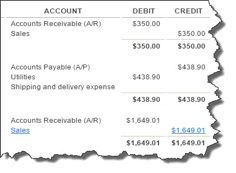

Read MoreWhether or not you’ve ever used accounting software, we think you’ll like using QuickBooks Online. It was designed for small businesses who have little or no accounting experience, and its user interface and navigation should be familiar to anyone who’s been around websites. We do have to say, though, that if you’ve never used any…

Read MoreTax identity theft once again topped the IRS list of tax scams for 2015. Here’s what you need to know if it happens to you. The warning signs. Have you gotten a tax bill you weren’t expecting based on income you never received? Has your return been rejected or your refund delayed? These unanticipated incidents…

Read MoreWe are excited to announce that Dana McGuffin CPA won the BEST OF READER’S CHOICE AWARD for BEST CPA in LIVING magazine for the second year in a row! Thank you, to our friends of the firm, clients, and LIVING magazine readers for voting Dana McGuffin CPA Best CPA in Northeast Tarrant county! Voting for…

Read MoreDid you know that federal tax law allows you to claim a credit when you pay someone to care for your kids while you’re at work? The child and dependent care credit is valuable because it reduces the amount of tax you owe dollar for dollar. Here’s an overview of the rules. The child care…

Read MoreIn June, the U.S. Supreme Court decided the fate of the premium tax credit under the Affordable Care Act (ACA). The main issue before the court was whether federal subsidies could be offered to people who purchased health insurance through the federal health insurance marketplace rather than through a state-run exchange. Under a literal reading…

Read MoreAre you traveling for business this summer? If you’re planning to take a tax deduction for your expenses, the rules may be more complicated than you think. Here’s a refresher. The general rule. “Travel” expenses are ordinary and necessary costs incurred while away from your normal working area. “Away” means you’re away from your tax…

Read MoreReports are the payoff for all of your hard work entering records and transactions. They can give you the critical data you need to help you make better business decisions. Now that you’ve been using QuickBooks Online for your company’s accounting, it’s probably unimaginable to think about going back to manual bookkeeping. Those file folders…

Read More