Dana McGuffin CPA Blog

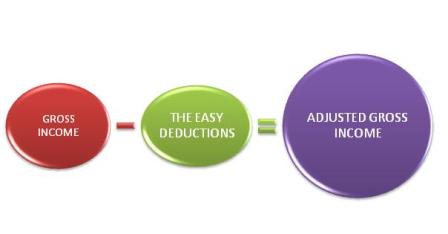

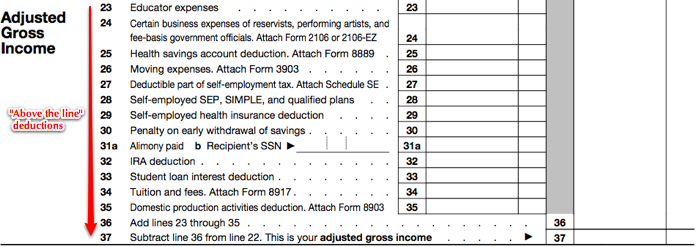

KNOWING “THE LINE” CREATES OPPORTUNITY A simple way to think about your 1040 tax return is focusing on a single line, your Adjusted Gross Income (AGI). Anything “above the line” creates an AGI that can yield tax opportunities or tax consequences for anything “below the line.” Being aware of “the line” and the impact it…

Read MoreThe 21st Century Cures Act, a new law signed late in 2016 that helps fund medical research, also provides a cure for the health insurance woes of small employers. Under this legislation, your small business may now offer stand-alone Health Reimbursement Arrangements (HRAs) for employees. An HRA is a special account used to pay health…

Read MoreIf your eyes glaze over when you read the word “depreciation” you are not alone. While depreciation is simply deducting the cost of business equipment over time, special tax provisions allow flexibility in how much can be expensed in a given year. The first solution is the Section 179 deduction. You are able to…

Read MoreYou did it again, friends! Thank you for choosing us as Southlake’s Best of the Best CPA Firm for the 7th year in a row! We have been honored to be voted Southlake’s best CPA firm since 2011 and it’s our privilege to serve community businesses, ministries, and churches. Thank you for the opportunity to…

Read MoreYour First Hour with QuickBooks Online Your first hour with any web-based application is probably spent exploring and clicking buttons, links, and other navigation tools to get the lay of the land. Whether you’re just launching a business or you’re going online with an existing company, take some time to get acquainted with QuickBooks…

Read MoreThere are many things that come in pairs because they make sense – peanut butter and jelly, salt and pepper, shoes – the list goes on and on. Travel insurance for business travel is no different. There are inevitable changes to business travel or circumstances that arise while away from home. One way to protect…

Read MoreA simple way to think about your 1040 tax return is focusing on a single line, your Adjusted Gross Income (AGI). Anything “above the line” creates an AGI that can yield tax opportunities or tax consequences for anything “below the line.” Being aware of “the line” and the impact it has on your tax return…

Read MoreIf your eyes glaze over when you read the word “depreciation” you are not alone. While depreciation is simply deducting the cost of business equipment over time, special tax provisions allow flexibility in how much can be expensed in a given year. The first solution is the Section 179 deduction. You are able to write…

Read MoreThe 21st Century Cures Act, a new law signed late in 2016 that helps fund medical research, also provides a cure for the health insurance woes of small employers. Under this legislation, your small business may now offer stand-alone Health Reimbursement Arrangements (HRAs) for employees. An HRA is a special account used to pay health…

Read MoreSave time and ensure that recurring transactions are processed as scheduled. You know how much time QuickBooks Online already saves you. Customer, vendor, and item records need never be entered again once they’re created for the first time. Pre-built forms use your record data to complete transactions quickly and accurately. Customizable report templates provide real-time overviews…

Read More