Posts Tagged ‘Best CPA Southlake’

Cures Act Authorizes New Breed of Small Employer Health Reimbursement Arrangements (HRAs)

The 21st Century Cures Act, a new law signed late in 2016 that helps fund medical research, also provides a cure for the health insurance woes of small employers. Under this legislation, your small business may now offer stand-alone Health Reimbursement Arrangements (HRAs) for employees. An HRA is a special account used to pay health…

Read MoreDana McGuffin CPA Wins Best of the Best CPA 7th Year in a Row

You did it again, friends! Thank you for choosing us as Southlake’s Best of the Best CPA Firm for the 7th year in a row! We have been honored to be voted Southlake’s best CPA firm since 2011 and it’s our privilege to serve community businesses, ministries, and churches. Thank you for the opportunity to…

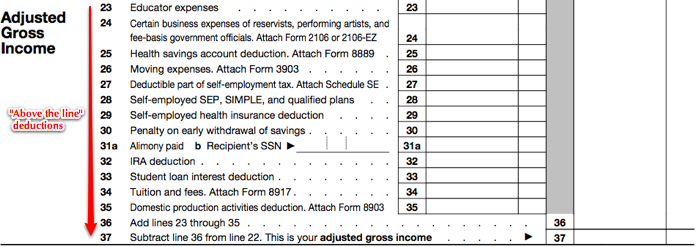

Read MoreKnowing “The Line” Creates Opportunity

A simple way to think about your 1040 tax return is focusing on a single line, your Adjusted Gross Income (AGI). Anything “above the line” creates an AGI that can yield tax opportunities or tax consequences for anything “below the line.” Being aware of “the line” and the impact it has on your tax return…

Read MoreHave You Created An Emergency Records Binder?

With weather-related disasters making the news these days, emergency preparedness may be front of mind. You probably have tools to cope with a flat tire, or a hurricane lantern or candles for times when the electricity to your home is interrupted. But have you considered what records you might need if your wallet was stolen?…

Read MoreRising Receivables Call For A Year-End Review

Rising business receivables can be a sign of a growing, prosperous company – or of troubles ahead. How can you know if your receivables are right-sized for your business? Start by breaking down the numbers. A report of your receivables listed by age will give you the information you need. Track the percentage of invoices…

Read MoreWhat is a 1099 and Who Should Receive a 1099?

What is a Form 1099-MISC? And who should receive a 1099? IRS Form 1099-MISC summarizes income from all non-employee compensation. It’s what independent contractors use to calculate and file taxes. You must send out a Form 1099-MISC to all contractors you’ve hired and paid more than $600 during the year; this includes any partnerships or…

Read MoreToys for Tots at Dana McGuffin CPA 2016

We are SO excited to be an official drop-off location for Toys for Tots 2016 and will be gratefully accepting new, unwrapped toys November 28th – December 9th, from 9AM to 5PM. Please join us for cupcakes and coffee at our 4th annual Toys for Tots gift reception Thursday, December 1st from 1-3PM. Our office…

Read MorePayroll Responsibilities Go Beyond Writing Paychecks

As an employee, you may not have thought much about the procedures behind the issuance of your paycheck. But as a new business owner, you’ll need to understand how federal employment taxes work because you’ll have to withhold these payroll taxes from your employees’ paychecks. Here’s an overview of four types of payroll tax. Social…

Read MoreSpeak Up About Your Finances

How often do you take time to talk about your finances? Once a year while preparing your tax return? Only when a financial emergency pops up? Or are money matters a topic you avoid entirely? If discussing financial goals makes you uncomfortable, you’re certainly not alone. Surveys by a national financial company found that money…

Read MoreHiring For the Summer? Know the ACA Rules

If you’re an employer, what you have to do to comply with Affordable Care Act (ACA) rules depends on the size of your workforce. When you have 50 or more full-time employees – a total that can include seasonal workers – you have to deal with additional reporting and coverage requirements known as the “employer…

Read More