Posts Tagged ‘Best CPA Northeast Tarrant County’

4 Key Elements of Great Business Books

Your bookkeeping system is the financial heart and lifeblood of your business. When set up and operating properly, your books help you make smart decisions and seamlessly turn your financial data into useful information. Here are four key characteristics to build and maintain a healthy bookkeeping system: Select the proper accounting method There are two…

Read MoreDon’t Let Disaster Befall Your Favorite Non Profit

The filing deadline for most non-profit organizations is May 15. Missing this deadline results in penalties that can devastate the organization’s budget, or worse, strip them of their non-profit status and make your donations non-tax deductible! Here’s what you can do to help them: Check the charitable status online. The IRS has a master list…

Read MoreTips to Protect Yourself From Tax Scams

Too many people downplay the threat of identity theft because it hasn’t been witnessed or experienced firsthand. This false sense of security can leave you exposed, especially during tax season. Here are some tips to keep your identity safe from scammers: 1. Be naturally suspicious. Understand that there are people out there trying to get…

Read MoreSummer Vacation Without Breaking The Bank

When setting your family budget, often the first thing that gets slashed is the summer vacation. However, if you plan ahead, you can find simple ways to save and keep your vacation on the calendar. Here are a few ideas. Flexible location. Sometimes you just want to get away to recharge and the location isn’t…

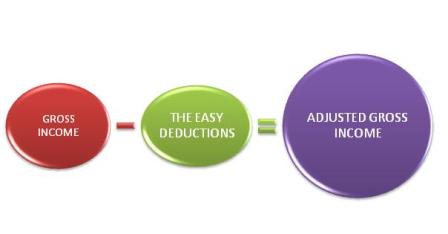

Read MoreKnowing “the Line” Creates Opportunity

KNOWING “THE LINE” CREATES OPPORTUNITY A simple way to think about your 1040 tax return is focusing on a single line, your Adjusted Gross Income (AGI). Anything “above the line” creates an AGI that can yield tax opportunities or tax consequences for anything “below the line.” Being aware of “the line” and the impact it…

Read MoreNew Phishing Scheme Involving W-2s

Dana McGuffin CPA has recently heard of an instance where this very scheme was perpetrated within a company in the DFW area. Be aware and take precautions by educating your staff. From IR-2016-34, March 1, 2016: The Internal Revenue Service today issued an alert to payroll and human resources professionals to beware of an emerging phishing…

Read MoreDana McGuffin CPA Voted BEST OF LIVING CPA in Northeast Tarrant County 2014-2016

We are so pleased to announce that Dana McGuffin CPA won the BEST OF READER’S CHOICE AWARD for BEST OF LIVING CPA in LIVING magazine for the third consecutive year! Thank you, to our friends of the firm, clients, and LIVING magazine readers for voting Dana McGuffin CPA Best CPA in Northeast Tarrant county for the third…

Read MoreHiring For the Summer? Know the ACA Rules

If you’re an employer, what you have to do to comply with Affordable Care Act (ACA) rules depends on the size of your workforce. When you have 50 or more full-time employees – a total that can include seasonal workers – you have to deal with additional reporting and coverage requirements known as the “employer…

Read MoreManage Your Tax Refund with Direct Deposit

Will you be receiving a tax refund this year? If so, you have the opportunity to make some smart financial choices – and best of all, you can make them painlessly. Here’s how: Direct deposit your refund. That way, all or part of your tax refund will automatically be deposited via electronic transfer system into…

Read MoreTime To Come Clean on Prior Year Tax Returns

Failing to file tax returns on time doesn’t necessarily make you a criminal, but the penalty for procrastinating can be punishing. What’s the price you’ll pay? The IRS can assess a failure to file penalty, which is usually 5% of your unpaid taxes per month, up to a maximum penalty of 25%. In addition, there…

Read More